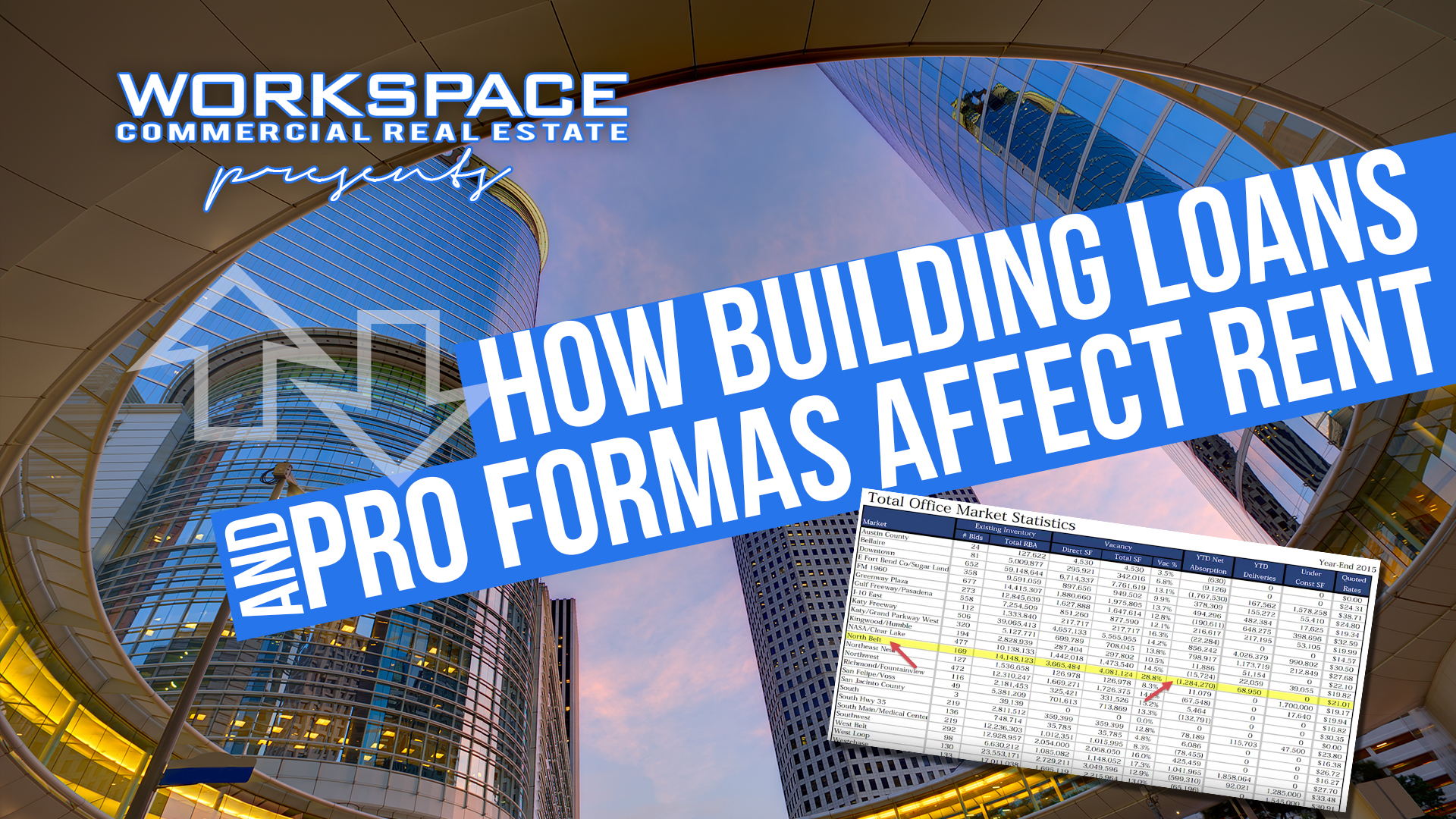

How Commercial Loan Terms Affect Rent

[fusion_builder_container hundred_percent=”yes” overflow=”visible”][fusion_builder_row][fusion_builder_column type=”1_1″ last=”yes” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” border_size=”0px” border_color=”” border_style=”” padding=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ class=”” id=””][fusion_text]Commercial Real Estate value is usually based on cashflow or rent. Banks will not allow landlords to go below a certain rent level.

Landlords are much more sensitive to occupancy when their property is under bank review for refinance.

Proforma

If you understand what the Landlord projected rents to be this year, you have a better idea of what types of deals they will do. The landlords in these markets that got hit the hardest are the ones that will be willing to give more attractive deals. Pay attention to which landlords have a building refinance coming up or just had a large tenant move or downsize. Not every building in this market will feel the pain, but if you know which ones are affected you know where look for opportunities to lease or purchase.[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]